Receive passive distributions on a quarterly basis

Your equity in the property increases through resident payments

Property values increase through natural appreciation and asset optimization

There are several tax benefits through real estate investing

We target A, B, and C Class properties from 20 to 300 units. We focus on this quantity of units because 20 units are too large for most small investors and 300 units is too small for institutional investors, thus allowing for less competition.

We purchase properties that earn predictable income

Underperforming properties with opportunity for value creation

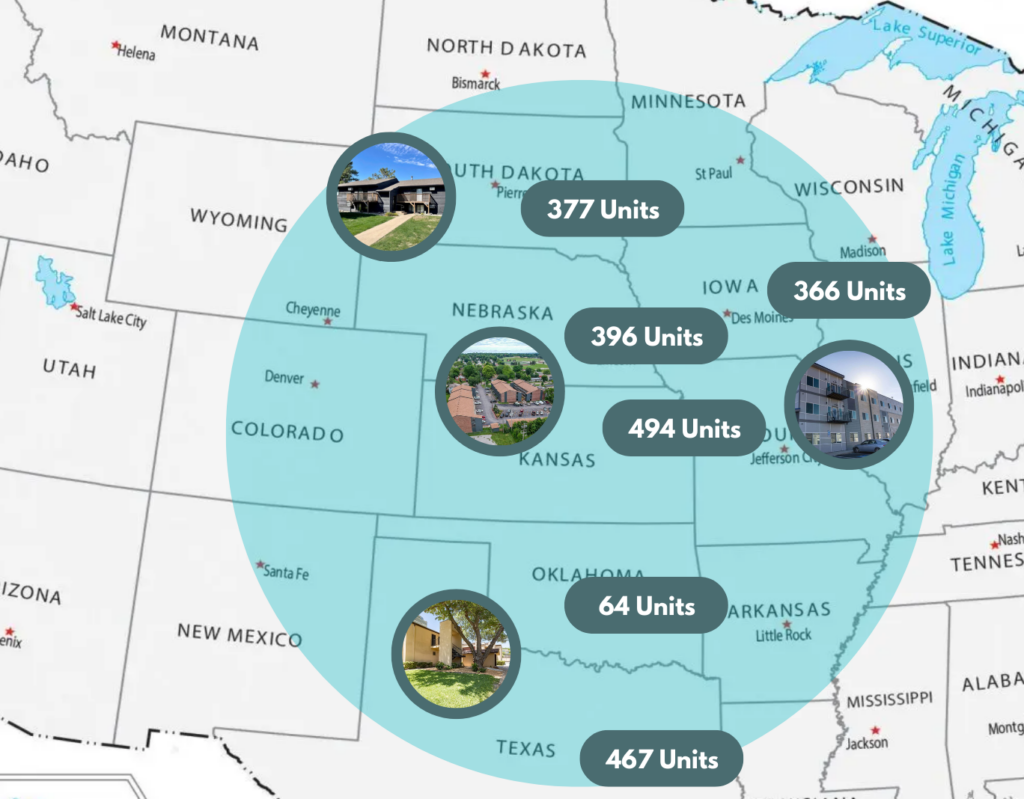

Midwest properties with proven market cycle stability

LeavenWealth’s investment approach targets cash-flowing assets with the ability to recapture 100% of the initial investment for continued passive income and generational wealth building.

The owners of LeavenWealth are seasoned business owners and have ownership in several companies.